Propel yourself onwards and upwards – to infinity and beyond! Read an excerpt from Bricks for Chicks: Property Investment for Women Who Kick Ass!

More about the book!

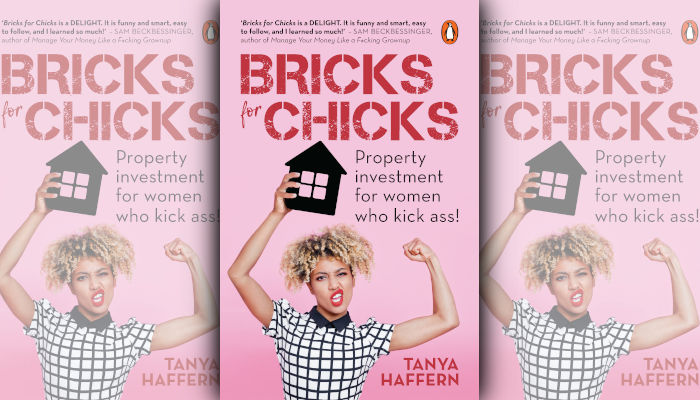

Penguin Random House has shared an excerpt from Bricks for Chicks: Property Investment for Women Who Kick Ass! by Tanya Haffern.

Bricks for Chicks introduces women (and men who are smart enough to read it!) to property investment, demystifying industry lingo and introducing the basic strategies a budding investor can employ to maximise returns in what can often turn into a field of broken dreams.

The book aims to grow the reader’s financial skill set to acquire the confidence to become financially independent. The author’s savvy, fun personality shines through as she delivers invaluable insights into property investment so that reading this book feels like having a fun conversation with a battle-sharpened, clued-up girlfriend who doesn’t spare the punches and, at the same time, makes you believe that you, too, can succeed in property investment.

The case studies keep the book light and humorous and make it easily accessible for novice investors. For anyone who wants to start investing in property but feels overwhelmed by the terminology, expenses and inherent risk, this book is going to change her life, starting TODAY.

Read the excerpt:

~~~

KNOW YOUR WHY

Ask any young kid what they want to be when they grow up and, without a moment’s hesitation, they will shout out their dream with confidence: A fireman! An astronaut! A vet! A movie star! A famous ballet dancer!

Somehow, along the way, life beats those dreams out of us and we end up settling for the safe job, the sensible job, the one that guarantees an income, the one that provides a well-beaten path for us to follow.

We leave our dreams behind, put our heads down and focus on paying the bills. But what if I told you that the very act of investing in property requires you to have a dream? To have a strong WHY? Your why can be defined as what really matters to you. What motivates you to get up in the morning? What keeps you going when the going gets tough? And believe me, there will be those moments! What do you really want from life? What will make you change your life for good and be worth the effort?

Knowing your why is important because it keeps you on track and gives you a reason to keep going. Where there is a will, there is a way! Spend some time thinking about what drives you, what made you decide to pick up this book and spend your precious time reading it, what makes you determined to build and grow a profitable property portfolio. Property is not a get-rich-quick scheme – it requires hard work and dedication to be successful. The road to financial freedom through property is littered with the broken dreams of people who didn’t have a strong enough why.

My advice is to figure out your why by asking yourself these questions and writing down the answers:

- What do I want my life to be like a year from now?

- Who do I want to help when I am financially free?

- What legacy do I want to leave behind?

- What kinds of opportunities do I want to be able to offer my children?

- What causes would I be able to support if I was financially free?

Once you have answered these questions, it’s time to get practical by working out the monthly expense figure that needs to be replaced by the income received from property. When you have a why, it becomes easy to create a plan.

Financial independence means having enough income to pay your living expenses for the rest of your life without having to be employed or dependent on others.

TURNING DREAMS INTO GOALS

To get anywhere in life, you need to set goals. Imagine getting into your car and just driving off without knowing your destination. That is essentially how you are living your life if you don’t have goals. Obviously, it makes more sense to enter your destination into the GPS when you get in the car and before you drive off.

The same principle applies in property investing. Without a goal, you will have no direction. You will likely drift from one thing to the next. The result? Dissatisfaction caused by a feeling that you’ve wasted precious time on things that are either irrelevant or unimportant.

Having well-chosen goals means that you will spend your time doing things that align with your vision. Everything you do will have a point and a purpose. Now is the time to dust off those long-forgotten dreams and convert them into goals.

Dreaming about financial independence can be a lot of fun. ‘Stop, don’t wake me now, my ice-cold piña colada just arrived, and my toes are sinking into the softest, whitest beach sand imaginable!’ Dreaming is magical. It opens your mind to new possibilities, and yet dreams by their very nature are often vague.

To make your dreams tangible and achievable, you must turn them into goals.

And your goals are informed by your WHY. Once you have your broad goals, start defining them more precisely. Draw up a plan, being as practical as possible. For example, you may want to be a wealthy property investor, but what does that mean exactly? What does ‘wealthy’ mean to you? How many properties would you need to own to consider yourself successful? Be clear on the details.

Make your goals measurable and time-bound. For instance, turn ‘I want to be financially free’ into ‘I want to be earning R20 000 in passive income per month from my property portfolio within the next five years.’

Remember to:

- write it down.

- peg it against a timeline.

- work back to today so you can figure out what needs to be done.

- plan every year, every month, every week and set daily targets.

- review your progress on a weekly basis. Time spent reflecting on your progress, or lack thereof, is rocket fuel to your goals.

Use it to propel yourself onwards and upwards – to infinity and beyond!

Head on over to www.tanyahaffern.co.za to download your free goal-mapping template.

BEGIN WITH THE END IN MIND

Once you’ve transformed a dream into a goal, you need to plot a course to get there. In other words, strategise! Identify intermediate steps that will act as intermediate goals. Imagine that your goal is to cross a river without getting wet. You need to look for a rock that sticks out above the water, take that first step, and then concentrate all your energy on finding the next viable rock to stand on. Take another step, look for another rock. You keep doing that until you get to the other side. Your intermediate goals are the rocks in that river.

The best way to do this is to begin with the end in mind and plan backwards from there. Ask yourself: What needs to happen just before I can reach this goal? In our river example, you need to find a rock that is close enough to the other side to allow you to step safely onto the riverbank. What do you need to do just before your final step? Write it down. Then ask yourself: What needs to happen just before I can do that? Keep going until you get all the way to the very first step you need to take. And just like that, you have a step-by-step plan to follow for turning a dream into reality.

Now you can start taking inspired action that will see you edging closer towards your dream. Let’s look at a property-related example.

The goal is to earn R10 000 a month in passive income from your property portfolio. Let’s say that the step before you achieve that goal is to find tenants for your fifth buy-to-let property, which will yield another R2 000 in passive income. The step before that might be to buy your fifth property. Before that, you’ll need to find said property. Same goes for properties one through four, all of which yield a minimum of R2 000 in passive income a month. Before identifying and buying that first property, you will need to consider developing the required skills. List the steps you will need to take, such as reading this book from cover to cover, signing up for a property-investing course, speaking to other investors, learning from mentors, sorting out your finances, finding investors, and understanding how to identify the right property.

Congratulations! You have a plan. Now start taking bold, determined action by following the steps, otherwise you have just spent all this time creating a detailed map of a road to nowhere. If this is the first time you are designing a plan – also known as a strategy – to achieve your property goals, it is likely to have flaws. That’s perfectly normal. You’re dealing with a lot of unknown factors. Your strategy might be missing some steps or have some

unnecessary ones. Some of the steps may even be plain wrong.

The flaws will only be revealed as you begin to implement your strategy and you see what really happens. It’s therefore crucial, once you have a strategy, to not look at it as final. It’s a first draft. Your actions are merely testing this draft. Implement the strategy, see what works and what doesn’t, and adjust as you learn from your experiences. Don’t let the fear of failure stop you from taking that first step. Give your plan a try and improve it as you go.

If you apply the mindset that this is the final plan, the one and only strategy, you’ll be oblivious to its flaws and you’ll persist with it when you should be changing it. A flexible ‘trial and tweak’ approach is much more effective.

Looking for more support on strategy? I got you covered! Go to www.tanyahaffern.co.za for your free strategy template.

Remember: I think, I believe, I achieve!

~~~

Categories Non-fiction South Africa

Tags Book excerpts Book extracts Bricks for Chicks Penguin Random House SA Tanya Haffern